GoHighLevel For Mortgage Brokers: (🔥 Guide & Free Template)

Today we’ll be looking in GoHighLevel for mortgage brokers and how you can scale up with this all-in-one marketing CRM software.

In the competitive landscape of the mortgage industry, staying ahead requires not just dedication, but also the right tools.

GoHighLevel represents a comprehensive solution tailored for mortgage brokers and loan officers aiming to streamline their operations.

It serves as an all-in-one marketing, sales, and client management platform that allows you to automate key processes, thus giving you a leg up in efficiently managing client relationships and scaling your business.

- GoHighLevel is an all-in-one platform enhancing mortgage brokers’ efficiency.

- Automation and centralization of client interactions are key benefits.

- The system’s features are designed to boost lead generation and conversion rates.

Why Mortgage Brokers Need GoHighLevel For Their Business

As a mortgage broker, adopting GoHighLevel can transform your business operations, enhancing both efficiency and client satisfaction.

Here’s how GoHighLevel caters to your specific needs:

Streamline Marketing Efforts: GoHighLevel consolidates your marketing tools into one platform.

With this centralized system, you can craft and automate marketing campaigns, ensuring consistent communication with your leads and clients.

- Automated Campaigns: Set up once, and let the system manage routine communications.

- Optimized Landing Pages and Funnels: Easily create high-converting online assets that draw potential clients.

Enhanced Client Relationship Management (CRM): At the heart of GoHighLevel is a robust CRM tailored for your industry.

It manages the entire customer lifecycle, nurturing leads into clients and beyond.

- Lead Capture and Nurturing: Monitor and follow up on leads effectively.

- Customer Retention: Employ targeted strategies to keep clients engaged.

Efficiency and Time Management: By automating repetitive tasks, you reclaim time that can be spent on more impactful work like advising clients or closing deals.

- Task Automation: Schedule reminders, follow-ups, and marketing communication.

- Client Interactions: Consolidate client communications in one place for ease of access and response.

Cost-Effective Solution: Cut down on the need for multiple expensive subscriptions by utilizing GoHighLevel’s comprehensive suite of tools tailored for mortgage professionals.

- Single Subscription: Access various marketing and CRM features without the hassle of multiple service providers.

- Reduced Overhead: Save on costs associated with managing disparate tools and systems.

Leveraging the power of GoHighLevel positions you to provide superior service, ultimately allowing you to scale your business more efficiently in a competitive market.

GoHighLevel Features For Mortgage Brokers

GoHighLevel offers a suite of features designed specifically for mortgage brokers to enhance their marketing and client relationship management.

Several key features are tailored to streamline operations and help grow your business.

#1. Marketing Automation

Automated Campaigns: Build and execute email and SMS campaigns automatically, saving you time and helping you reach clients effectively.

Landing Pages & Funnels: Quickly create optimized landing pages and funnels to capture leads, with easy customization to reflect your brand.

#2. Client Management

Centralized Interactions: Keep all client communications in one place for simpler tracking and follow-ups.

Lead Management: Sort and prioritize leads to focus your efforts more efficiently.

#3. Business Scalability

White-label Options: Present the platform under your own brand, enhancing your professional image.

Dynamic Tool Integration: Seamlessly integrate with other tools and software used in real estate and mortgage lending for a more cohesive workflow.

Here are some other key features that GoHighLevel provides for mortgage brokers:

- CRM Functionality: GoHighLevel’s CRM system allows mortgage brokers to keep track of all client interactions, manage contacts, and organize leads. Brokers can segment their contacts into different lists and manage their pipelines effectively.

- Lead Capture and Forms: As a mortgage brokers, you can create custom forms and landing pages to capture leads. These can be integrated into websites or used in marketing campaigns to gather information from potential clients.

- Email Marketing: GoHighLevel provides email marketing tools that enable brokers to create, send, and track email campaigns. These tools can be used for nurturing leads and keeping in touch with existing clients.

- SMS Marketing: The platform also supports SMS marketing, which can be a highly effective way to reach clients with appointment reminders, updates, and promotional messages.

- Funnel Builder: With GoHighLevel’s funnel builder, mortgage brokers can create sales funnels to guide potential clients through the process of becoming qualified leads and eventually customers.

- Appointment Scheduling: The software includes an appointment scheduling feature that can be synced with the broker’s calendar. This allows clients to book their own appointments, reducing the back-and-forth communication typically required.

- Task Management: Mortgage brokers can manage and assign tasks within the GoHighLevel platform, ensuring that nothing falls through the cracks and that all team members know what they need to do.

- Reporting and Analytics: GoHighLevel provides reporting tools that give insights into marketing campaign performance, sales data, and more. This helps mortgage brokers make data-driven decisions.

- Reputation Management: The platform can help mortgage brokers monitor and manage their online reputation by tracking reviews and feedback across various channels.

- Integration: GoHighLevel can integrate with various other tools and platforms, such as Zapier, which allows for seamless connectivity with a wide range of applications and services.

- Mobile App: Mortgage brokers can manage their business on the go with GoHighLevel’s mobile app, which provides access to the CRM, communications, and other essential features.

- White Labeling: For agencies that work with mortgage brokers, GoHighLevel offers white-labeling options so that they can offer a branded experience to their clients.

- VoIP Calling: This allows you as a mortgage brokers to make and receive calls directly through the platform.

These features are designed to help mortgage brokers manage their workflows, nurture leads, and maintain client relationships more effectively.

By using GoHighLevel, mortgage brokers can centralize their operations, automate many of their marketing and follow-up tasks, and ultimately grow their business.

How to Use GoHighLevel For Mortgage Brokers

To effectively utilize GoHighLevel for your mortgage brokerage, begin by setting up your GoHighLevel account and automated marketing campaigns.

With GoHighLevel you can centralize your operations, from client communications to campaign management.

Let’s walk you through how your mortgage brokerage can be powered up with GoHighLevel.

Step 1: Creating Your Account

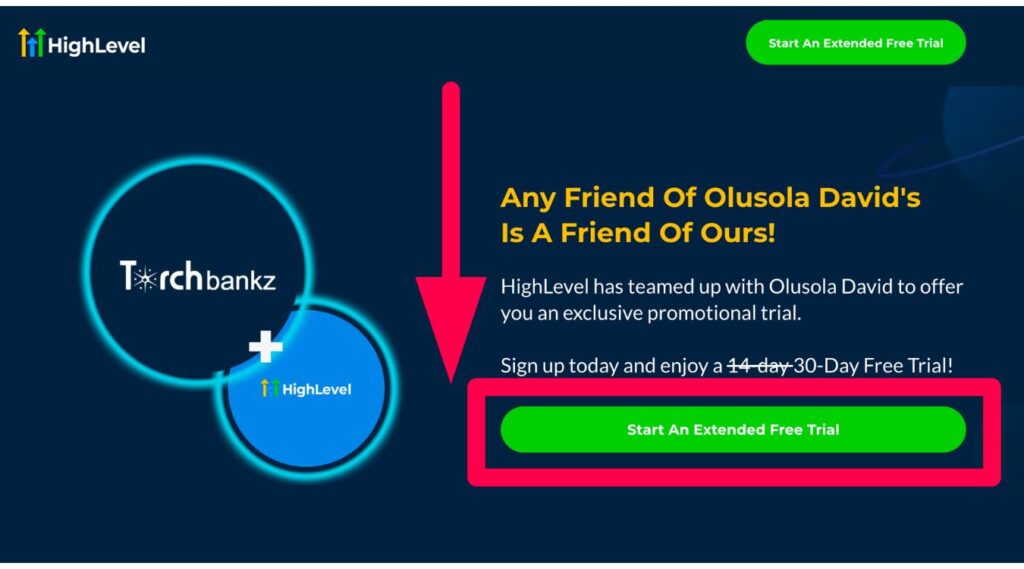

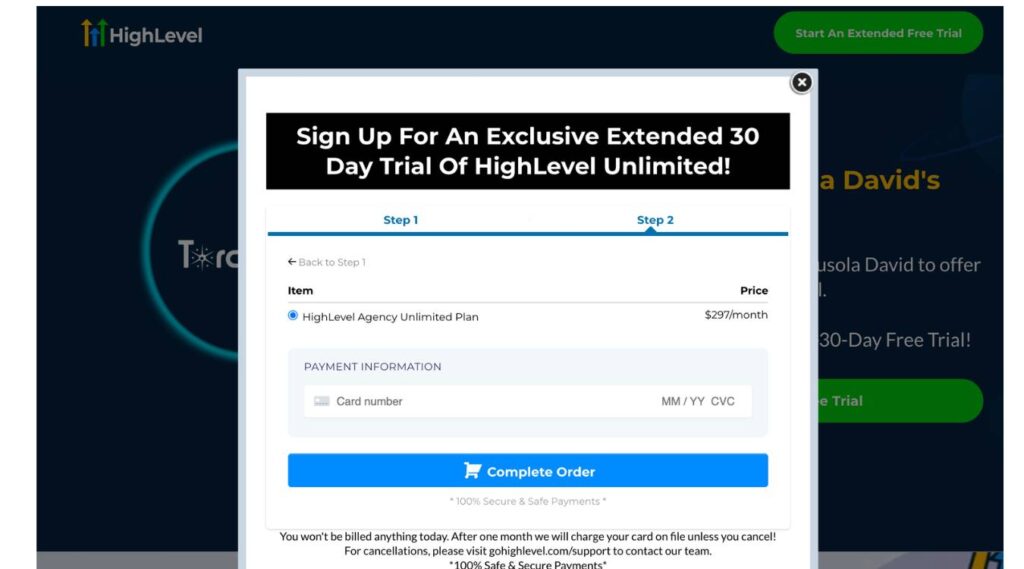

You can take advantage of my 30-day GoHighLevel free trial instead of the usual 14 days to get familiar with HighLevel and properly set up your business.

This promo is only available for Torchbankz readers.

So, to begin with, you’ll need to create a GoHighLevel account.

Once your account is set up, you’ll have access to the platform’s features and tools specifically designed to help you grow your restaurant business.

Step 2: Set Up Your Website with GHL Mortgage Template

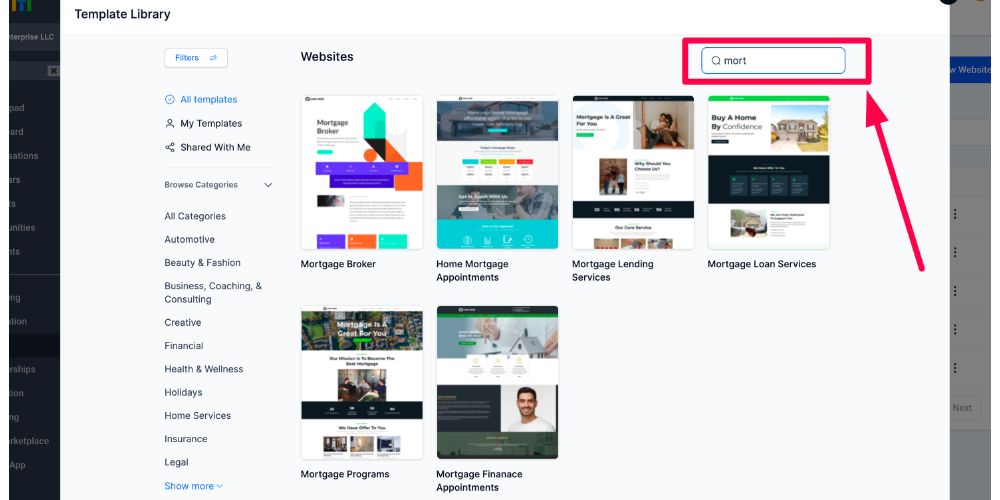

At this stage, you need to set up your website using GoHighLevel’s Mortgage template.

I equally have the template set up for you already, you can log in and install it here…

This template is tailored to the needs of your industry, making it easy for you to create a visually appealing and user-friendly website.

As you can see from the image all of the hard work is done by GoHighLevel, all you need to do is swipe your logo in and also change the text to match your brand.

So, to do this, navigate to the “Site” tab, select the “New Website” option, and search for the “mortgage” template.

More templates are been added to the GoHighLevel template library regularly. There is also an option to create and customize your site from scratch.

So, once you’ve seen a template you want to use for your website, you can click on it to start customizing it to meet your preferences.

The GoHighLevel website builder tool offers a beautiful drag-and-drop feature to customize your website even when you have limited experience.

GoHighLevel Mortgage Sales Funnel Template

To deploy the GoHighLevel sales funnel template, navigate to the “Site” tab, select the “New Funnel” option, and choose the “Mortgage” template.

For a mortgage business, effectively using GoHighLevel Funnels can help streamline lead generation, nurture customer relationships, and ultimately increase sales.

Setting up a sales funnel for mortgage brokers using GoHighLevel involves few steps.

The goal of a sales funnel is to capture leads, nurture them, and ultimately convert them into clients.

Here’s a step-by-step guide on how to create an effective sales funnel within GoHighLevel:

Your Offer:

- Clearly define what you’re offering, whether it’s a free mortgage consultation, a guide to home buying, or competitive mortgage rates.

Create a Landing Page:

- Use GoHighLevel’s funnel builder to create a landing page that highlights your offer. This page should be clear, concise, and include a strong call-to-action (CTA).

- Include a form on the landing page to capture lead information, such as names, email addresses, and phone numbers.

Set Up Lead Capture Forms:

- Customize the form fields to gather the information you need from potential clients.

- Ensure that the form is integrated with the GoHighLevel CRM so that new leads are automatically entered into your database.

Develop Email and SMS Campaigns:

- Create automated email and SMS sequences within GoHighLevel to follow up with leads who have submitted their information.

- Provide valuable content that educates and nurtures leads, such as mortgage tips, market trends, or success stories.

Segment Your Leads:

- Use tags and lists to segment your leads based on their interests, behaviors, or where they are in the buying process.

- Tailor your communication and follow-up campaigns based on these segments to increase relevance and engagement.

Implement Automation Triggers:

- Set up triggers for automated actions within GoHighLevel, such as sending a welcome email when a new lead is captured or alerting a team member to follow up with a lead who has engaged with your content.

Schedule Appointments:

- Utilize GoHighLevel’s appointment scheduling feature to allow leads to book consultations or calls with you directly from the emails or SMS messages.

- Sync your calendar with the scheduling tool to avoid double bookings and ensure you’re available for the appointments.

Monitor and Optimize:

- Use GoHighLevel’s analytics and reporting features to track the performance of your sales funnel.

- Monitor metrics such as conversion rates, click-through rates, and the overall ROI of your campaigns.

- Continuously optimize your funnel based on data insights. Test different aspects of your funnel, like headlines, copy, and CTAs, to improve performance.

By following these steps, you can create a comprehensive sales funnel using GoHighLevel that not only captures leads but also nurtures them through the customer journey, resulting in more conversions and closed deals for your mortgage brokerage.

Remember to personalize the journey for your leads as much as possible, as this can greatly enhance the effectiveness of your sales funnel.

![Is GoHighLevel a Pyramid Scheme? [Here’s The Truth]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2024/01/Highlevel-and-Pyramid.jpg?lossy=1&strip=1&webp=1)

![GoHighLevel Certification Program: [Everything You Need Know]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2023/11/HighLevel-Cert-1.jpg?lossy=1&strip=1&webp=1)

![Dashclicks Black Friday Sale: [Up to 50%]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2023/11/Dashclicks-Black-Friday.jpg?lossy=1&strip=1&webp=1)

![Duda vs GoHighLevel: [Detailed Comparison]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2024/01/GoHighLevel-vs-Duda.jpg?lossy=1&strip=1&webp=1)