GoHighLevel For Financial Advisors: (Guide & Free Template)

In today’s article, I’ll show you how GoHighLevel For financial advisors can help automate and transform your financial advisory business.

As a financial advisor, you understand the importance of efficiency and GoHighLevel offers a suite of tools to help you leverage technology to better serve your clients’ needs.

GoHighLevel’s appeal lies in its all-in-one solution that caters specifically to the challenges faced by financial advisors.

With features aimed at revolutionizing marketing and sales strategies, it can play a pivotal role in helping you grow your business.

The platform’s tools are aimed at simplifying workflows, improving efficiency, and fostering business growth.

For financial advisors looking to elevate their practice, GoHighLevel provides various features and applications that can be beneficial in managing client relationships and enhancing service delivery.

- GoHighLevel provides financial advisors with a suite of tools to streamline their practice.

- The platform offers solutions for efficient workflow management and marketing.

- GoHighLevel aids in improving client management and growing financial advisory businesses.

Why GoHighLevel is Ideal for Financial Advisors

As a financial advisor, your aim is to bring clarity and growth to your clients’ financial situations.

GoHighLevel offers tools that support your mission through efficiency and automation. Here’s why it’s a game-changer for your practice:

- Client Management Efficiency: With a powerful CRM at its core, GoHighLevel lets you manage your client data effectively. You’ll have all your client interactions and histories at your fingertips, streamlining the advice process.

- Streamlined Workflows: Automate routine tasks with custom workflows that ensure leads and clients receive timely and relevant communication. This not only saves time but also maintains a consistent level of service.

- Boosted Sales Tools: Engage every lead with multi-channel outreach including SMS and email, boosting your chances for conversion and, ultimately, ROI.

- Marketing Automation: From customizable website templates to targeted campaign tools, GoHighLevel helps you automate your marketing efforts, allowing you to focus more on strategy and less on manual tasks.

- Team Collaboration: Keep your team on the same page with shared information and collaborative tools.

- Scalability: As your client base grows, GoHighLevel grows with you. Implement scalable processes that support business expansion without sacrificing quality of service.

By adopting GoHighLevel, you’re not just investing in software; you’re embracing a partner that complements your expertise in financial guidance, helping you to automate, scale, and enhance your growth and efficiency endeavors.

Key Features of GoHighLevel For Financial Advisors

As a financial advisor looking to enhance your client engagement and management, GoHighLevel offers a multitude of features tailored to streamline your process and foster growth.

The CRM tool is a standout, encapsulating a comprehensive system to efficiently manage client information and interaction histories.

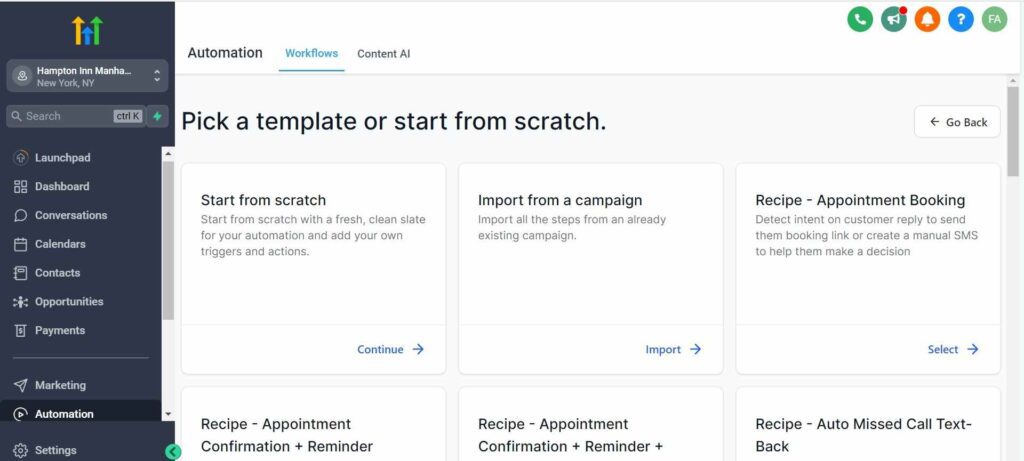

Sales and Workflow Automation: Elevate your sales strategy through automation that can nurture leads through optimized workflows. This tool helps reduce the manual effort on your end, improving your team’s efficiency and potentially boosting your ROI by prioritizing leads with the highest conversion potential.

Marketing Automation: Automate your marketing campaigns to maintain consistent communication with prospective and current clients. Customizable email templates, SMS messaging, and automated responses are designed to keep your client base engaged and informed without oversaturating their inbox.

Scalability: GoHighLevel supports your business’s growth with features giving you the flexibility to segment contacts, personalize client interactions, and manage a larger client base without compromising the quality of your service.

Efficiency: Streamline your team’s tasks with GoHighLevel’s integrated tools, leading to better use of your resources and time. By handling repetitive tasks, your team can focus on more complex aspects of client management and strategy.

Leveraging these features improves overall efficiency, client satisfaction, and may result in a better return on investment.

By utilizing GoHighLevel, you’re well-equipped to elevate your financial advisory services and adapt to an evolving market.

Setting Up GoHighLevel For Financial Advisors

When it comes to enhancing your efficiency and scaling your financial advising business, setting up GoHighLevel is a substantial step forward.

It offers a suite of tools for client management, sales enhancement, and workflow automation to help maximize your ROI.

Create Your GoHighLevel Account

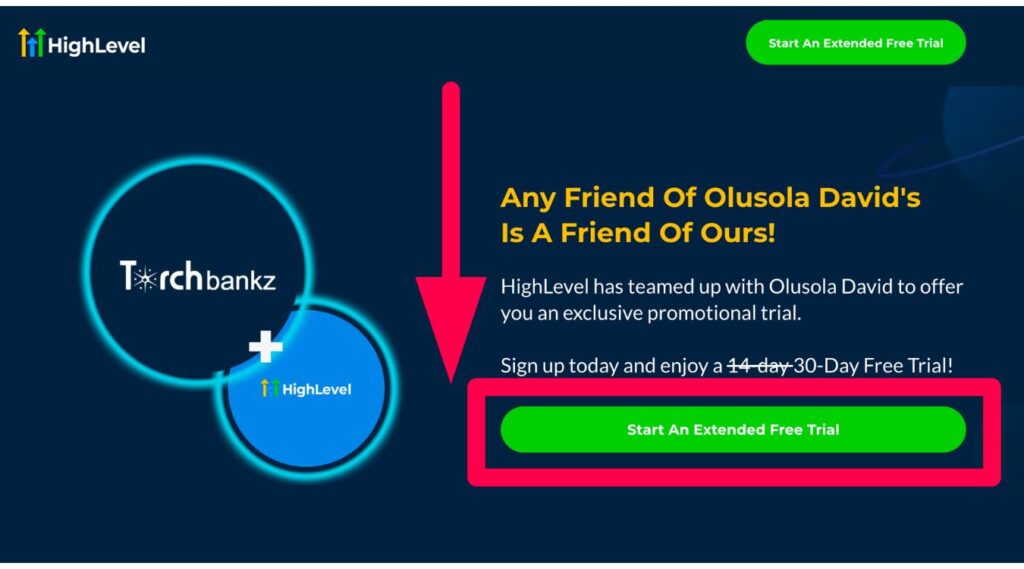

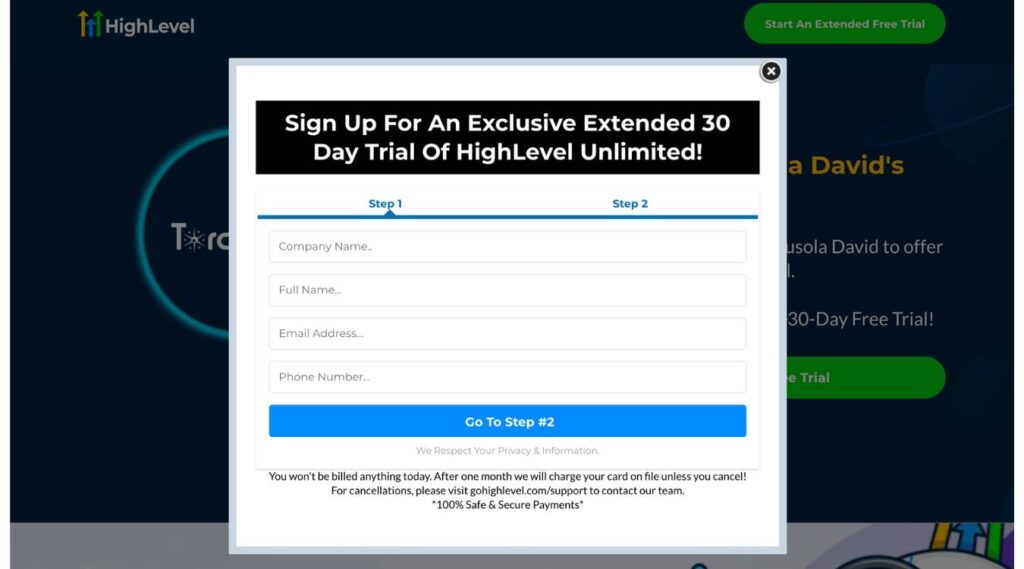

To kickstart your journey with GoHighLevel, you need to sign up for an account.

Visit the GoHighLevel website, choose a subscription plan that fits the size of your team and the scale of your operations, and provide the necessary details to create your account.

You can also take advantage of my 30-day GoHighLevel free trial instead of the usual 14 days to get familiar with HighLevel and properly set up your business.

This promo is only available for Torchbankz readers

Create a Website with GoHighLevel as a Financial Advisor

Building a strong online presence begins with creating a professional website.

GoHighLevel offers you customizable website templates tailored to the needs of financial advisors.

You can select a template and use the intuitive drag-and-drop editor to add your services, about us information, and contact details.

- Select a Template: Choose a design that resonates with your brand.

- Customize Content: Add your unique text, images, and client testimonials.

You can also use my already set-up template that’s tailored to industry specifications and needs.

Choose from a variety of Finance-themed templates and customize them with your branding, images, and content.

To do this, navigate to the “Site” tab, select the “New Website” option, and choose the “Finance” template.

Customize Your Brand With GoHighLevel Snapshots and Templates

Your brand’s identity in the digital sphere is crucial.

Use GoHighLevel’s snapshots and templates to ensure your brand is represented consistently across all materials.

- Templates for Communications: Personalize email and SMS templates with your brand’s voice.

- Visual Consistency: Apply your color scheme and logo across all your snapshots to maintain a professional look.

Set Up your Sales Funnels

Optimizing your sales funnels is essential for converting prospects into loyal clients.

GoHighLevel provides tools to automate and track your sales process.

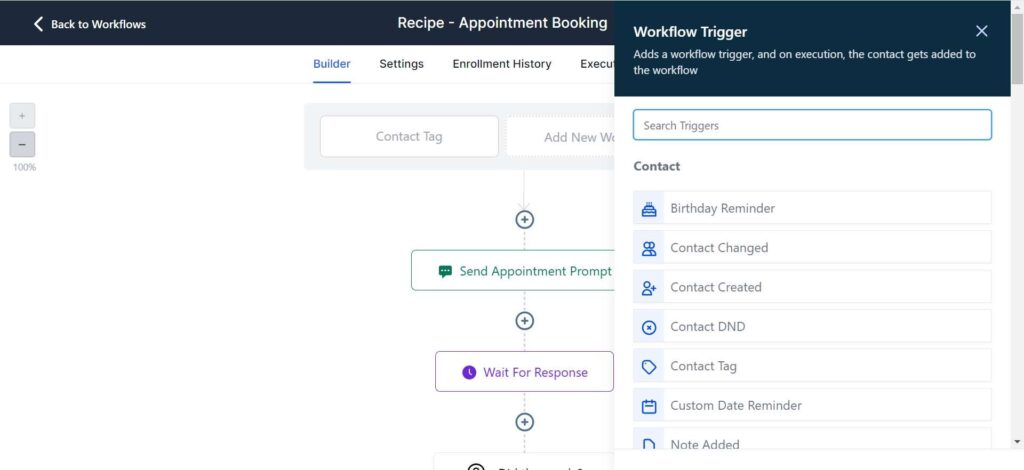

- Automation Workflows: Set up email sequences and reminders to nurture leads.

- Track Progress: Monitor where clients are in the sales funnel to identify opportunities for follow-up or re-engagement.

By leveraging GoHighLevel’s CRM and sales tools, you can streamline your client management and drive growth for your financial advising business.

How to Use GoHighLevel for Financial Advisors

GoHighLevel is a robust platform that enables you to manage client interactions and automate your marketing efforts with efficiency.

#1. Optimizing Client Communication

With GoHighLevel, your client communication becomes more streamlined.

Personalize your outreach by segmenting your clients based on their needs and interests. You can use GoHighLevel’s features to:

- Automate appointment scheduling: Set up an online booking system that allows your clients to book appointments with you at their convenience. This system syncs with your calendar to prevent double bookings and manage your availability effectively.

- Send targeted messages: Create custom email campaigns or text messages that cater to specific groups of clients. Utilize templates or craft personalized messages to keep your clients informed and engaged.

- Track interactions: Keep a detailed record of every interaction with your clients, from emails sent to calls made, ensuring you always know the last point of engagement and can personalize follow-up communication.

By using these tools, you ensure that your interactions are both personal and professional, keeping your clients satisfied and engaged with your services.

#2. Lead Generation and Sales Funnels

Your ability to attract leads and guide them through a sales funnel is key to growing your financial advisory business.

A strategic sales funnel can systematically convert prospects into qualified clients.

Creating Effective Landing Pages

Landing pages are the first touchpoint of your lead funnel and are vital in capturing leads. Your landing page must be:

- Clear and concise: Communicate your value proposition quickly and effectively.

- Visually appealing: Use a professional design to build trust and interest.

- Mobile-responsive: Ensure your page looks great on any device.

- Optimized for conversion: Include a lead capture form that is simple and enticing for prospects to fill out. Here are the essentials for your form:

| Lead Capture Form Essentials | Description |

| Fields | Collect only necessary information to qualify leads effectively. |

| Call to Action | Use compelling language that encourages action, like “Get Your Free Financial Consultation.” |

| Privacy Policy | Reassure potential leads with a link to your privacy policy. |

Automated Lead Capture and Follow-Ups

Automating your lead capture and follow-up process ensures that no potential client falls through the cracks. Implement these steps to enhance efficiency:

- Automated Email Responses: As soon as a lead fills out the form, trigger an email that acknowledges their interest and outlines the next steps.

- Follow-Up Sequence: Plan a series of automated emails that provide additional value, establish your credibility, and nudge leads further down the sales funnel.

- Lead Scoring: Use automated systems to score leads based on their actions and information, helping you to prioritize the most qualified prospects.

By using these strategies, you build a foundation for successful lead generation and sales conversions within your financial advising firm.

#3. Streamlining Financial Planning Processes

In the competitive realm of financial advising, leveraging tools like GoHighLevel can significantly enhance your efficiency, especially in managing client appointments and tasks.

Appointment Scheduling Automation

With GoHighLevel, you can automate appointment scheduling to save time and reduce the hassle of back-and-forth communication. Here’s how:

- Integration: GoHighLevel syncs with your calendar, offering clients real-time availability to book appointments.

- Reminders: It sends automatic reminders to reduce no-shows, which ensures that both you and your clients respect each other’s time.

| Availability | Client Action | Your Action |

| Visible on Calendar | Book the best slot | Confirm instantly |

| Fully Integrated | Receive instant confirmation | Monitor effortlessly |

By streamlining this process, you set the stage for more meaningful interactions focused on investment goals rather than administrative setup.

Task Automation and Client Portfolios

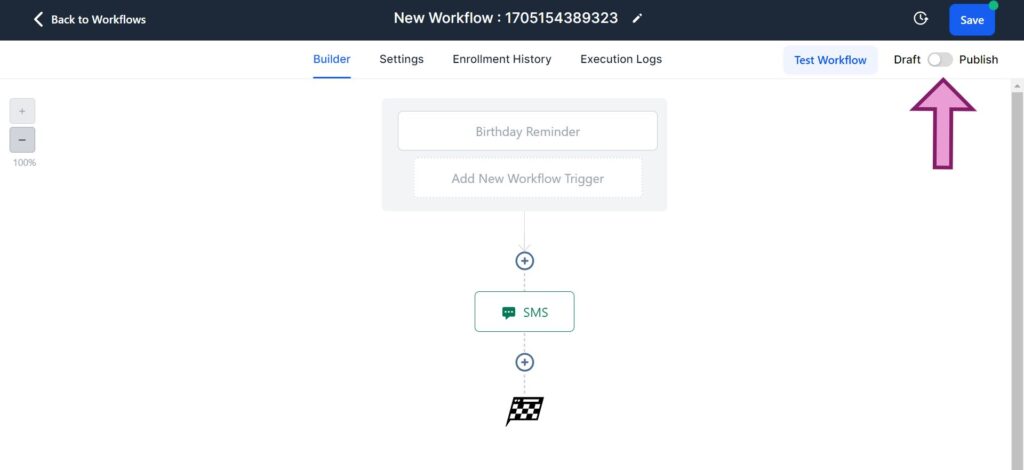

Task automation in GoHighLevel lets you focus more on client portfolios and less on routine tasks:

- Workflow Automation: Create custom workflows for regular reviews, updates, or outreach actions.

- Client Management: Track investment progress and adjust strategies to align with changing investment goals.

Here’s a quick look at what task automation can do for you:

- Automatically generate portfolio reports.

- Conduct investment rebalancing with triggers based on client’s goals or market changes.

- Schedule alerts for important milestones or tasks, keeping you proactive.

Employing automated tasks allows you to manage client portfolios with precision, ensuring that each client’s investment strategy remains on track and is well-aligned with their expectations.

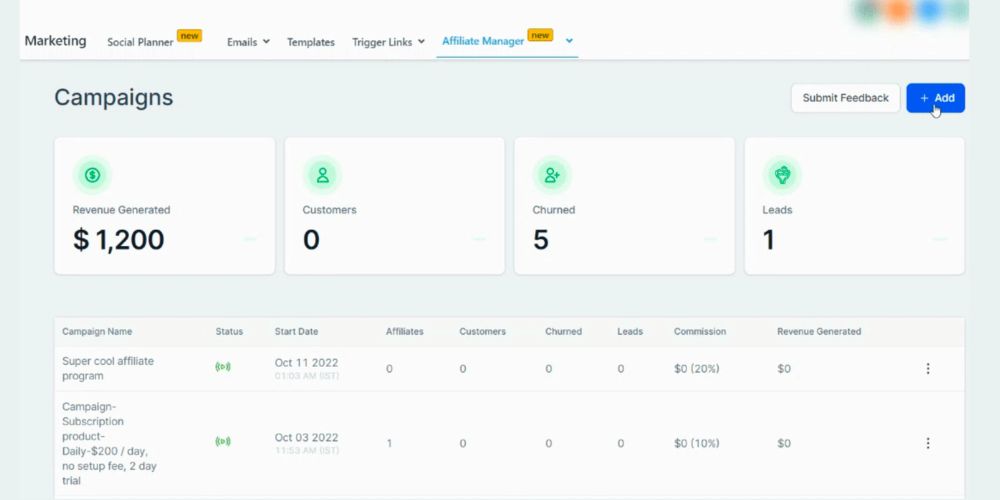

#4. Boosting Conversion with Marketing Campaigns

When you adopt robust marketing campaigns through GoHighLevel, your conversion rate is set to soar.

By effectively managing your social media and email campaigns, you’ll engage clients more directly and meaningfully.

Social Media Integration and Management

Integrating social media into your marketing strategies allows you to connect with clients where they spend much of their time.

With GoHighLevel, you can:

- Monitor and manage multiple social media platforms in one place.

- Create and schedule posts to maintain a consistent online presence.

- Track engagement such as likes, shares, and comments, enabling you to tailor your approach to what resonates with your audience.

Tips for Social Media:

- Engage Regularly: Keep the conversation going by responding quickly to comments and messages.

- Curate Content: Share valuable insights and articles that position you as a thought leader.

Email Campaigns and Analytics

Your email campaigns can become a cornerstone of your marketing efforts when you leverage the analytics provided by GoHighLevel. Effective tactics include:

- Segmenting your contacts into dynamic lists for tailored messaging.

- Utilizing automation to send targeted follow-ups based on user behavior.

Email Analytics to Watch:

- Open Rate: Track this to gauge how well your subject lines perform.

- Click-Through Rate (CTR): Measures the engagement within your emails—how many recipients are clicking on the links you provide.

By focusing on these specifics, you’ll optimize your email campaigns for higher conversion rates.

#5. Enriching Advisor-Client Relationships

In the age of digital transformation, your key to success as a financial advisor lies in enhancing how you manage and support your client relationships.

GoHighLevel offers robust tools that cater specifically to these areas, ensuring your clients feel valued and well taken care of.

Effective Client Relationship Management

By leveraging GoHighLevel’s suite of CRM features, you can organize client information efficiently, allowing for a more targeted approach to client management.

The following table illustrates typical client management activities and how GoHighLevel facilitates each:

| Client Management Activities | GoHighLevel Solutions |

| Tracking Client Interactions | Log calls, emails, and meetings automatically. |

| Client Data Organization | Keep client financial profiles, preferences, and goals in one place. |

| Task and Workflow Automation | Set up reminders for follow-ups and reviews to ensure you never miss an important client milestone. |

Customer service excellence becomes natural when you have full visibility into your clients’ journey, enabling you to anticipate their needs and address them proactively.

Personalized Client Services and Support

GoHighLevel’s platform empowers you to provide personalized support that reflects each client’s individual financial goals and investment portfolio. For example:

- Actionable Insights: Use analytics to offer tailored advice, making sure each client knows they’re receiving individual attention.

- Communication Channels: Keep the lines of communication open with integrated messaging, ensuring prompt support and client engagement.

- Customized Reporting: Generate reports that resonate with your clients, focusing on simplicity and relevance to support their financial success.

Such attentiveness enhances trust and strengthens the advisor-client relationship, which is crucial for long-term client retention and satisfaction.

![Kartra Affiliate Program: [Earn $1,819 Recurring Commission]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2019/12/kartra-affiliate-program-768x359.jpg?lossy=1&strip=1&webp=1)

![GoHighLevel Certification Program: [Everything You Need Know]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2023/11/HighLevel-Cert-1.jpg?lossy=1&strip=1&webp=1)

![Flowtrack vs GoHighLevel: [Features Comparison] 2024](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2024/01/HighLevel-vs-flowtrack.jpg?lossy=1&strip=1&webp=1)

![Is GoHighLevel Worth It? [2024]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2024/01/GoHighLevel-worth-it.jpg?lossy=1&strip=1&webp=1)