How to Use Stripe For Payments As A Non US Resident [2024]

In this post, I’ll shed more light on how to use stripe to process payments as a non US resident for your online business.

I’ll assume you offer services online or have an e-commerce/dropshipping store or you simply need Stripe to receive payment on your business website.

Whichever it may be, Stripe is still by far the #1 payment processor you can use to process payments on your website across the Globe.

Using stripe allows you to easily accept payment on your website via credit card without transferring your customers to another website.

The payment processor is embedded on your website which makes it invariably quick, easy and flexible for your customers to make payments.

It doesn’t matter what country your customer is paying from, your price in dollars is charged on your customer’s credit card and remitted to your stripe account immediately.

We all know how important it is to receive your hard-earned profits after you must have invested your time and funds in the business.

And using Stripe makes this easier and reliable! Even better than PayPal.

However, the bad news we already know is that Stripe is only available for residents in the US and a number of other countries. While others are left to their fate.

Let’s quickly have a look at the list of countries stripe is not supported.

Countries Stripe is not supported

- Pakistan

- Russia

- Vietnam

- Nigeria

- Ghana

- Kenya

- Philippines (Limited)

- India (Limited)

- Croatia (Limited)

- Gibraltar (Limited)

- Indonesia (Limited)

- Liechtenstein (Limited)

- Bangladesh

- Turkey

- Thailand

- South Africa

- Uganda

- Ethiopia

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guernsey

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Heard & McDonald Islands,

- Honduras

- Iceland

- And few others…

What if your country is outside Stripe availability by default, is all hope gone? Nah!

This now brings us to the good news that you can still use Stripe legally even if your country is not part of the supported country.

How can you achieve this?

All you need to do is register a business in the US and use this information to set up your Stripe account legally.

And this is exactly what I’ll be doing justice to in a bit…

How to Set Up Stripe Account for Non-US Resident or Non-Supported Countries

For you to set up a Stripe account legally without any future issue as a non US resident you’ll need the following:

- US Business Formation (LLC)

- EIN (Employer Identification Number) or Tax ID

- US Physical Address

- A US Phone Number

- Finally, US Bank Account

Okay. Before you get overwhelmed, everything can be set up within a few days and equally at a relatively low price.

The most important of all is creating a Limited Liability Company (LLC) in the US in other for you to get your Tax ID (EIN).

Once you’ve gotten your EIN or Tax ID, you can then proceed to create your Stripe account.

Below is a message from Stripe confirming the validity of setting up a stripe account as a non US resident.

If you’re a non-US citizen and have a US based business with an EIN you would be able to open a Stripe account. When we request the last four digits of your SSN, you can just enter ‘8888’ please ensure that you enter a valid tax ID (EIN) that has been provided for your business. We will then reach out at a later stage and request either a passport or government issued ID to verify your identity.

If you don’t have a SSN/ITIN, you are only able to register as an LLC Corporation, Non-Profit or Partnership. If you sign up as a sole Prop/Individual, we require a valid SSN/ITIN even if you have a valid EIN

So basically, as a non-resident you can create an account with Stripe so far you have a business entity in the US and a valid EIN number.

Luckily for you, you don’t have to pay for the business formation, however, you do need to pay for state filing and tax ID.

Setting Up an LLC for Your Business in The US

One of the perks of having your business set up in the US isn’t limited to Stripe usage. You can have several similar businesses under the registered business.

Also important is the fact that you don’t have to have a Social Security Number (SNN) to have your business set up in the US.

You just need to choose a NAME for your business and decide on the state you want it to be registered in the US.

However, you need to be careful about which state you decide to set up your business entity. This is because some states charge high state filing (Business Registration) and as well as annual business tax.

But I do find;

- Colorado

- New Mexico

to be quite affordable.

Colorado charges a $10 annual Tax fee and $50 state filing, while New Mexico charges a $50 state filing and $0 annual Tax fee.

At least at the time of writing this article. You could also do further research on that if you want.

The state annual tax is a tax you pay on your business at the end of every year. So, they vary based on the state you choose to set up your business.

States like California and Hawaii should definitely be out of your pick because they are freaking high on tax.

But not to worry, the sole purpose of this post is to show you how to get it done as easily as possible and at the cheapest fee.

I’m equally not based in the US, but I have my business set up in the US, so I can equally use Stripe to process payments as a non-US resident.

I was able to do this using Northwest Registered Agent and New Mexico as my business state because they’re relatively cheap.

The good news is I’ve been able to partner with them because I know many people will need this service, and I want them to have it at the best place.

Plus, there are various services out there charging as high as 500 – $1000 for this same purpose. A good example is Stripe Atlas. But at the end of this post, I’ll show you how you can get it done for less than $290.

Coming from someone who’s also living in a Country where Stripe is not enabled, I know how beneficial it can be for your online business.

Most especially my blog readers!

How to Form Your Business LLC in the US Using Northwest Registered Agent

In other to be able to use Stripe in Nigeria to process payment as a non-US resident you do have to form a business entity in the US using Northwest Registered Agent.

Northwest Registered Agent offers online business incorporation services, as well as additional business services such as record books, operating agreements, federal tax identification numbers, etc.

I did intensive research before finally picking Northwest Registered Agent for my business LLC formation in the US. Their service was on point, and I was moved to partner with them to share with you guys.

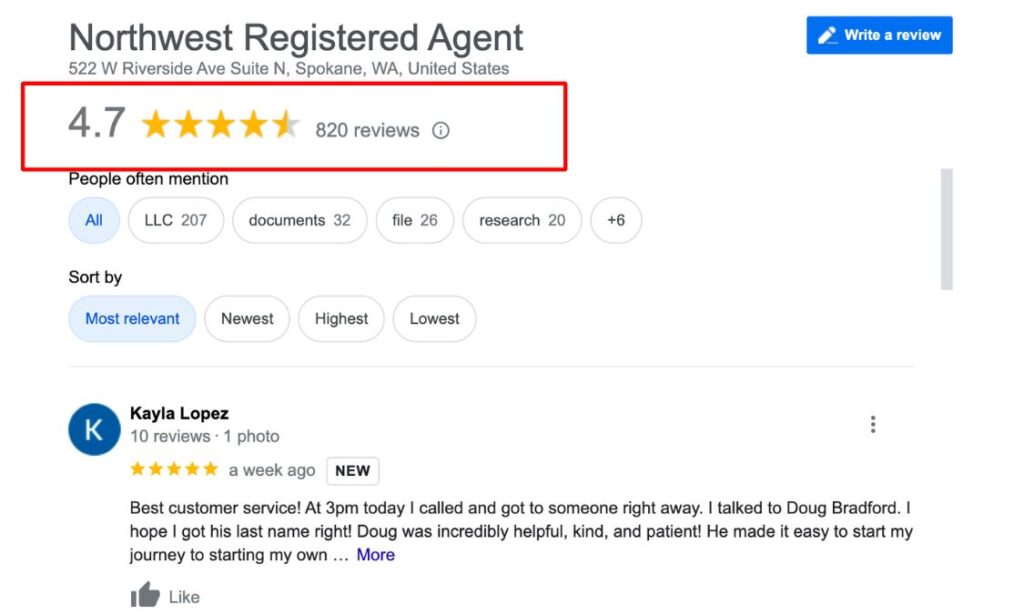

Going through their reviews on Google reviews should show you exactly what I’m talking about; they are simply the best out there.

Now let’s proceed to form your LLC at Northwest Registered Agent:

Setting up your LLC with Northwest Registered Agent is really straightforward; I’ve broken it down into the step-by-step guide below.

All you need do is follow the steps, and your LCC and Tax ID will be set up.

Step 1. Head Over to Northwest Registered Agent

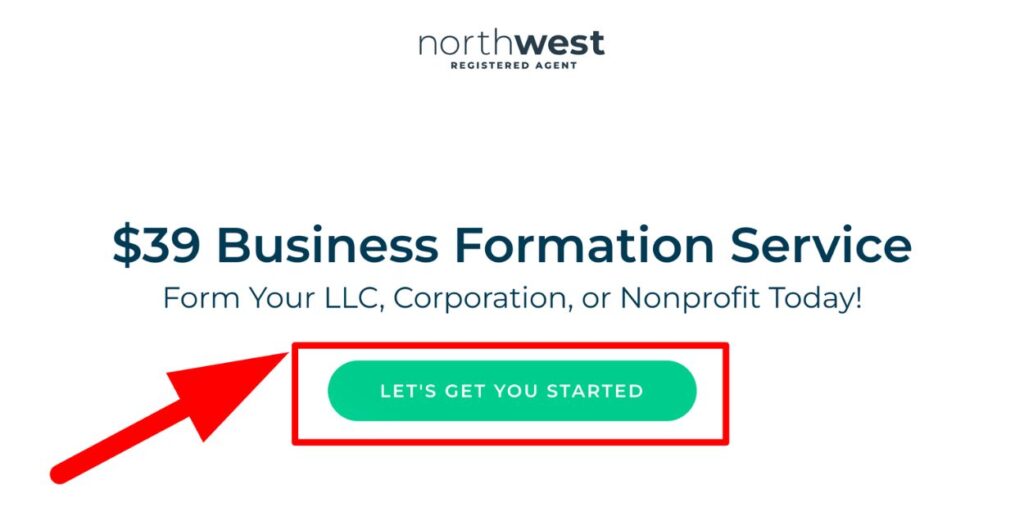

First, you need to head to Northwest Registered Agent to get started. Upon getting to the web page, click on the “Let’s Get You Started” button…

The next page is your business entity type and the state you want to form the LLC.

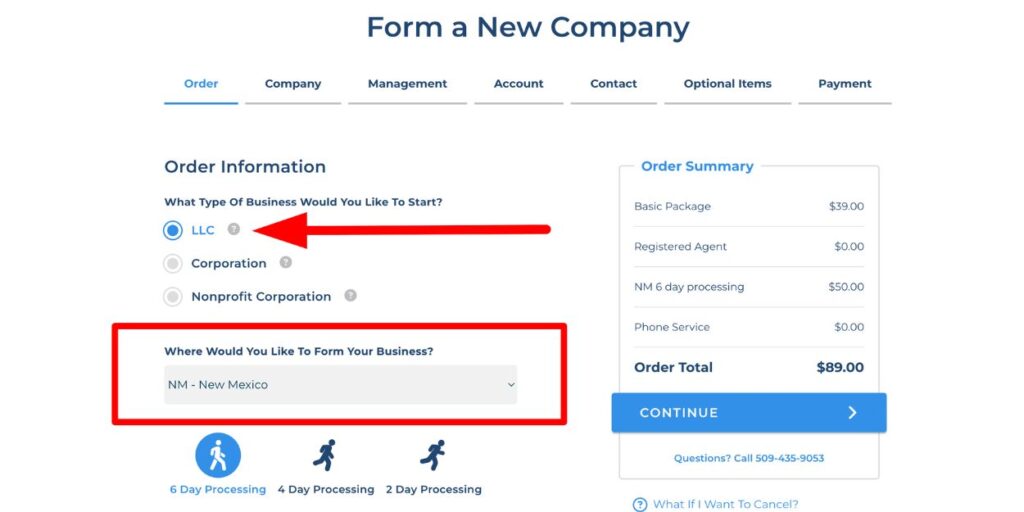

Step 2. Choose Your Business Entity and State

Simply choose LLC (Limited Liability Company) from the drop-down menu and choose your state. You can go with New Mexico because of the low cost and the free annual tax fee.

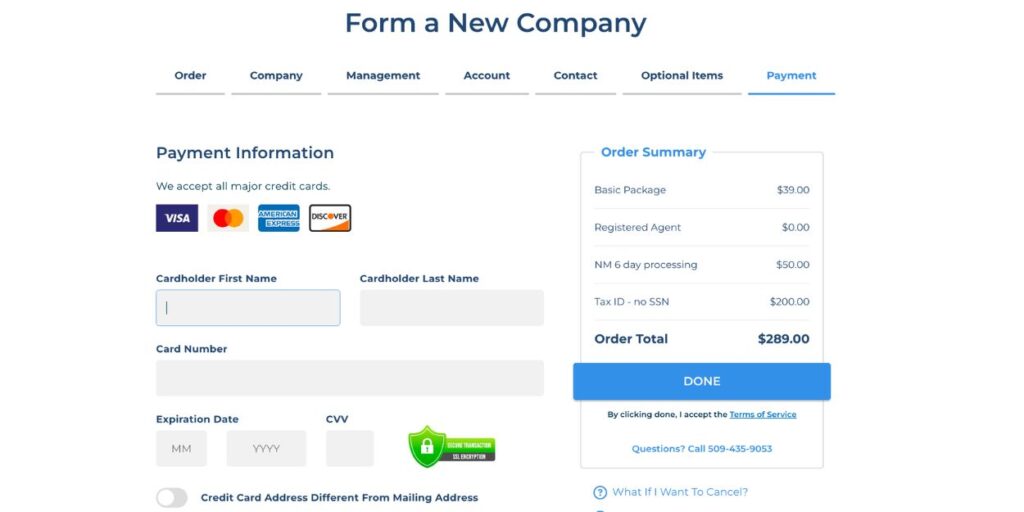

The business formation fee itself is $39, and the state fee for New Mexico is $50 as you can see from the image above.

You can also see the option of spending it up below the state. The opt 6 days, 4 days, and 2 days processing for your business formation.

After that, click on “Continue”

Step 3. Enter Your Companies Information

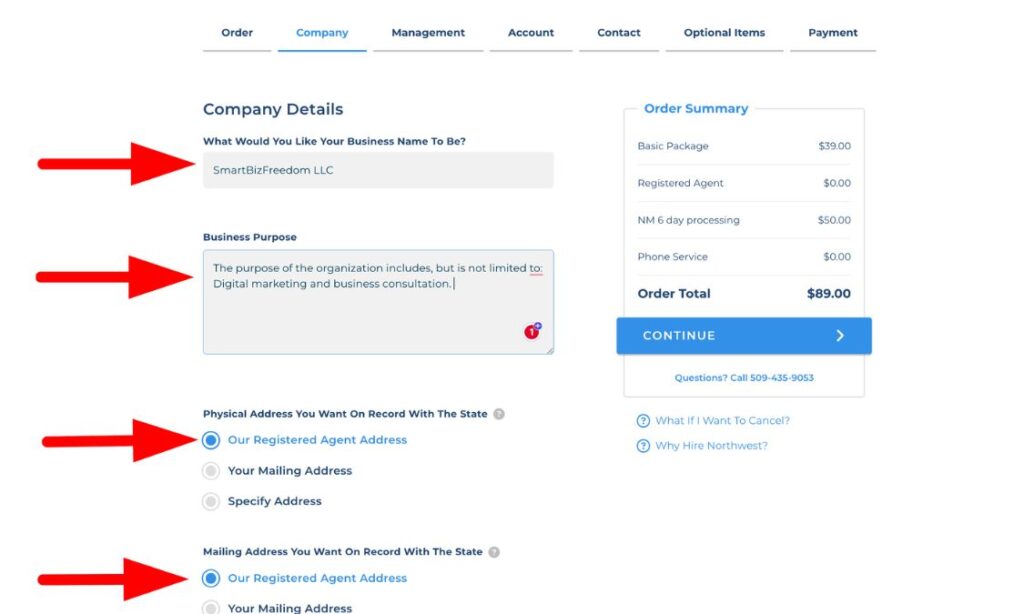

As I said earlier, you’ll need to pick a name for your business and a search will be carried out on it to check if it’s still available.

Your business name will be created immediately upon state approval if it’s available. However, in the case where your proposed business name is not available, you’ll need to adjust the name or find another one.

But it’s not going to cost you any additional fee!

What you need to do here is enter your proposed business name, A good example is Smartbizfreedom LLC and also write a short description of the business.

Another good option for using a Northwest registered agent is the fact that you don’t have to bother about a US address for your company.

Northwest registered agent gives you the option to use their address as your business address. Some other agents require you to rent a virtual address for this.

But with Northwest Registered Agent, it won’t cost you extra money. For the mailing, you could also use them only if you don’t have a mailing address option.

If you want your physical documents, add a US mailing address for this option.

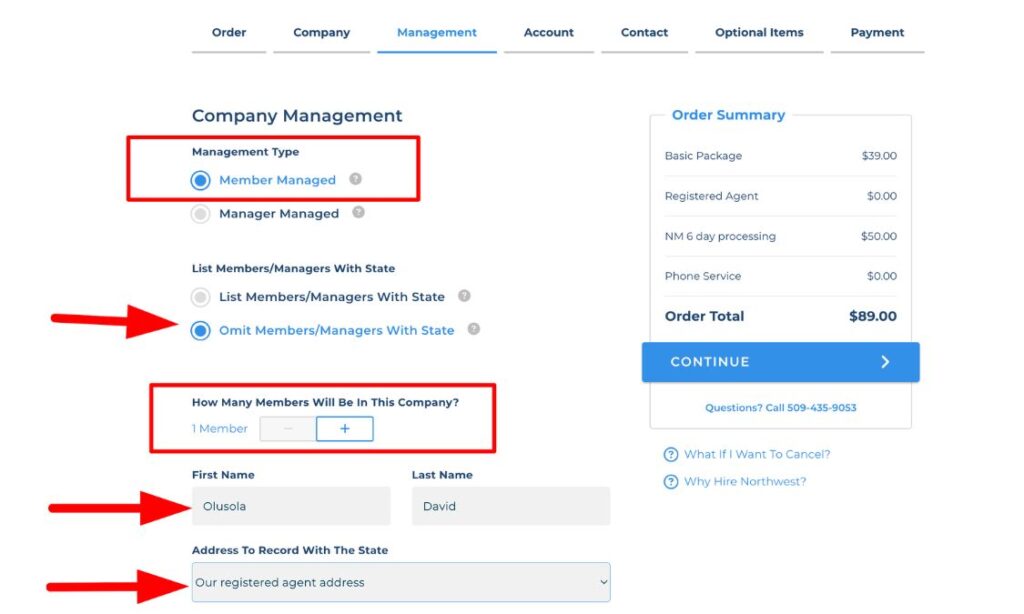

Step 3. Enter Management For Your Company

The next step is about the business owner. At this stage, you’ll need to if the business is member-managed or manager-managed.

Next, tick the “Omit Members/Manager with the state, which will keep your business details private from the state you’re forming it. After that, indicate how many members will be in the company.

Since it’s a single-man business, you can leave it at one member and then enter your name as you can see mine from the image above.

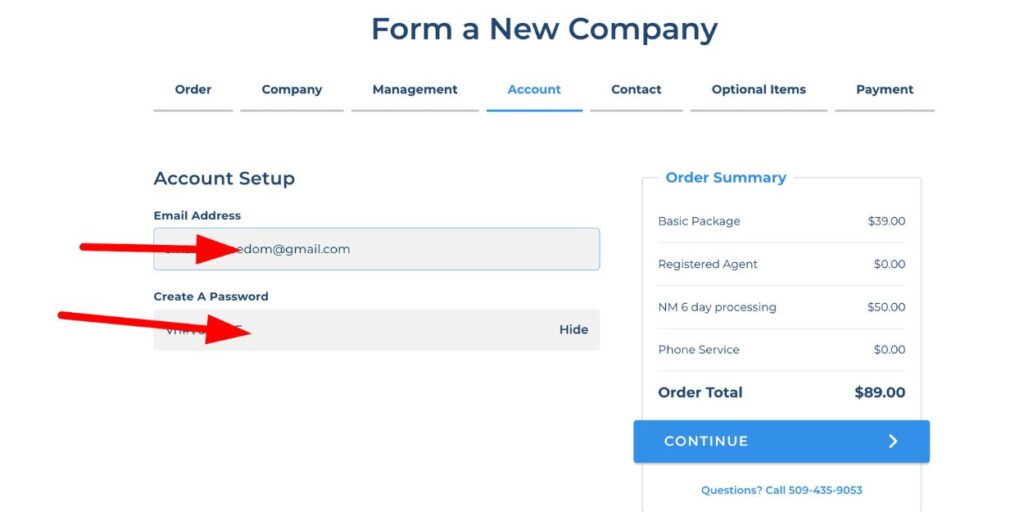

Step 4: Create an Account with Northwest Registered Agent

At this stage, you need to create an account with Northwest registered agent so you can manage your business from their dashboard.

As you can see from the image above, enter your email address and create a password for logging in to your Northwest registered agent account.

After that, click the continue button.

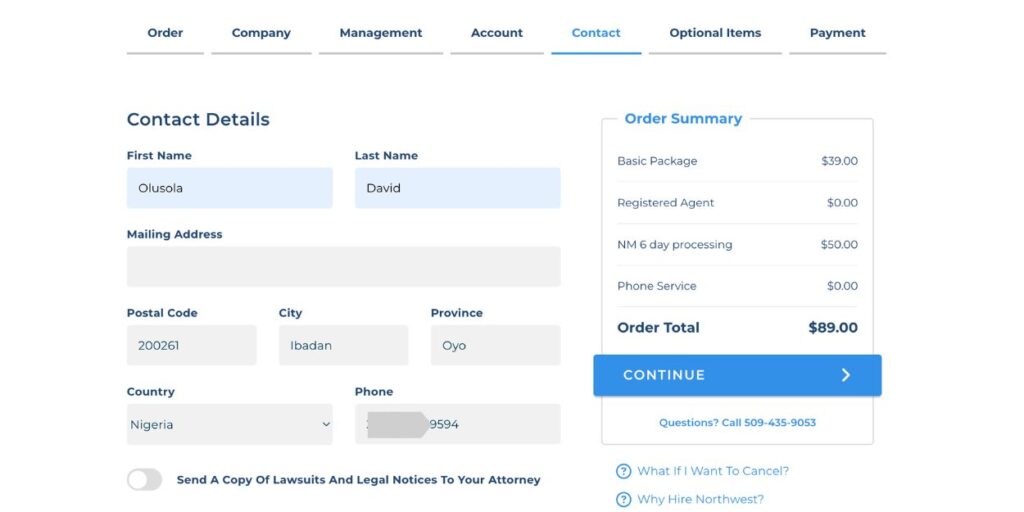

The next thing you want to do is enter your contact details, which will be your contact details for Northwest Registered Agent.

So make sure it is your original details and the country you’re living in.

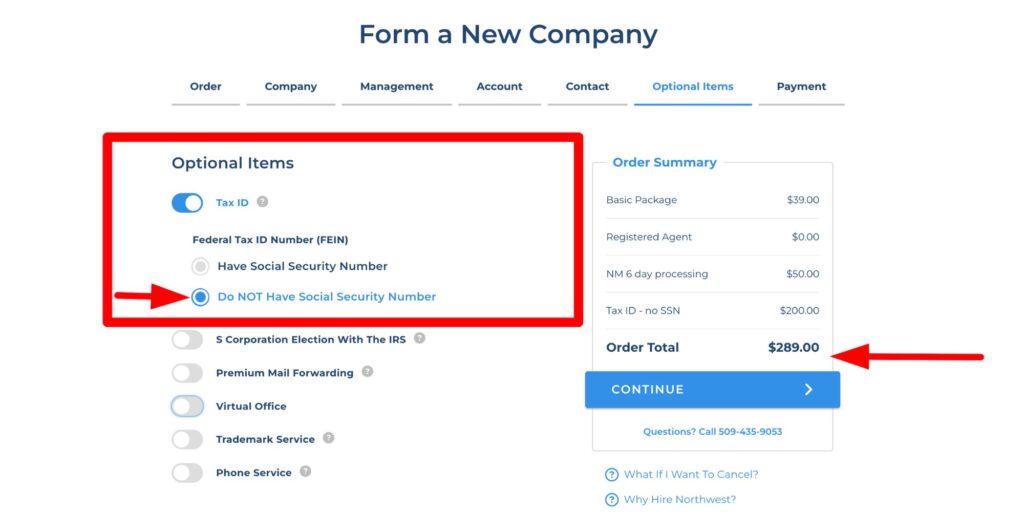

Step 5: Getting Your Tax ID (EIN)

Northwest registered agents will get your EIN or Tax ID for just $200 if you don’t have an SSN or you’re a foreign entity, which is relatively cheap compared to other services out there that may look cheap but have hidden charges.

Northwest is 100% transparent about all the money you’ll be paying.

So you’ll only pick the Tax ID here; other things are additional upsell. For the phone service, I did a video on how to get one at an affordable price.

Step 6. Pay and Checkout

The last thing left here is to enter your card details, make the payment for your business registration, and get your EIN as soon as possible.

Opening Your Stripe Account to Process Payments As A Non-US Resident

You can watch the above video and see how you can set up your Stripe account.

Once your business LLC is registered, your business will equally receive a tax ID or EIN. Which is part of what we need to create your Stripe account.

To create your Stripe account, head over to Stripe.com and create your account. Enter your email address and full name.

After the registration, you’ll need to activate it by filling an account application. In the application, you’ll need to enter your US company details, EIN, your personal details, and a digital copy of your government-issued ID.

Once everything is done correctly you should be approved in a few days.

After this, you can now successfully use stripe to process payments on your website. All your funds will be remitted to your US bank account.

Which brings us to how to create a US bank account to cash your Stripe payments!

Opening a US Bank Account with Payoneer

This is very much easy since we have Payoneer for that. All you need to do is register with Payoneer.com, connect with Global payment service and you’ll be able to get your virtual US bank account.

Once this is done, you can now have your funds move to Payoneer and cash it in your local currencies. It’s as easy as that.

However, you need to access your Stripe account to do this. From your account, you can proceed to the payout sections and add your Payoneer account number and that’s it, you’re all set up.

You are now a proud owner of a business in the US plus you can also process payments with stripe. Isn’t that cool?

Conclusion

With the above formation, you can now receive payment twice as you used to. If you have a PayPal business account this will also be an addition to it.

Your business is also fully legalized in the US in a real place and real state. I hope you find this very helpful.

That’s it on how to use Stripe to process payments as a non-US resident. What are your thoughts on this? Let me know them using the comment box!

![List of Best TikTok Ads Spy Tools For eCom Marketers [2024]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2022/08/Image-20.jpg?lossy=1&strip=1&webp=1)

![List of BEST Print-On-Demand Sites For Artists [2024]](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2022/11/White-Label-Business-25.jpg?lossy=1&strip=1&webp=1)

![Sellfy Pricing [2023] Monthly COST, Subscription & DISCOUNT](https://b2317160.smushcdn.com/2317160/wp-content/uploads/2020/05/Sellfy-Pricing-Plan.jpg?lossy=1&strip=1&webp=1)

Thanks it is helpful but how can I pay in dollars do I use my bank to make payments and can I start the mini importation via stripe?

You can use it to process payment for any business

Lovely information.

Thank you.

Glad you like it

Hi David,

Thanks for this wonderful article. I want to learn from you on drop shipping and e commerce. I want to have my own e commerce site. Do you have a step by step guide you are selling to guide me. Something I can read and open my e commerce store without having to recourse to you for help.

Let me know please

I’m glad you like it…

I don’t have a course yet but I’m working on it.

You definitely know when it’s up!

Dear David,

This is good like many of your posts! Kudos.

I am processing an Alidropship store but is right now stranded because of payment gateway. Alidropship recommended 2checkout but I am almost getting frustrated over their condition of providing proof of address with utility bill bearing my name, but I don’t have because a joint billing metre is use with another apartment and bears the Landlord’s name.

I have presented other documents like driver’s licence and National ID card bearing same address but rejected.

Please what’s the way out or can I change the payment gateway to STRIPE?

Thank you.

Stripe is far better than 2checkout if you can change I’ll suggest you do!

Is there any other way to open a U.S. bank account other than Pioneer?

Yeah, that means you have to fly over to the US in-person to Set it up. Other than that there’s no other way!

Yes you can use wise or grey

Thank you Mr David for this exposure. I have a webstore that is under construction, it is patterned to be used for drop shipping business.I also bought one of your eBook on mini importation business which is very educative.But,I want to request that you be my mentor especially on drop shipping business because of your knowledge and experience .Earnestly waiting for your favourable response

Appreciate the commendation… don’t worry I’ll keep posting more contents that’ll be helpful for your dropshipping journey.

Great information David.

Can I tell a relative living in the US to have all these done for me or must I use online platform?

The relative can use their address and Phone when required but you still going to need a company like IncAuthority… except they are very familiar with the process, they can help you get it done without an online platform.

Hola qué tal,

Soy de México y tengo un tienda ecommerce, actualmente sólo uso PayPal y necesito integrar Stripe para poder aceptar tarjetas de crédito. Tengo una cuenta personal en Payonner

Al configurar Stripe no aparece “LLC”, sólo aparece “Individual, sole proprietor, or single member LLC” que supongo debe elegirse. ¿El sitio web debe indicarse forzosamente?

En la parte del propietario único no puedo elegir un estado de México, sólo da la opción de estados de USA. ¿Qué debería hacer en esa parte?

Quedo atento a tus amables respuestas.

Saludos,

Gabriel

Hello Gabriel

You can’t choose Sole sole proprietor, except you’re in the US. If LLC is not appearing send a mail to Stripe support that you want to register an account as a non-US resident.

But mind you, Your LLC should be up and running already because you’ll need the number and your TAX ID

I´m so glad to read your reply David,

I have any doubts:

1.- The number TAX ID is the EIN?

2.- Do I need to put the website domain?

3.- Can you help me with a URL about taxes and accounting?

Thanks again!

Gabriel

Thanks David for this powerful and informative article

Hi,

My business is web development & Marketing. I have all these…llc,Payoneer & EIN…still stripe rejected my application saying it a high risk business.

what to do and how to clear it, because someone asked me money to get it done saying there is a trick to bypass it. can you help me?

Thanks

Why don’t you register using an e-commerce store? They seemed more cool with those.

Great info bro. Your blog is really inspiring. Thanks and keep sharing these things with us. You’re the best

Hello David,

I got a call from INC Authority and they clarify and send a mail to me that i need to complete the process with the information detailed below.

——————————————————————————-

For a Complete LLC or Corporation you will need to take these steps:

State Registration Fee

EIN/Tax ID Number

Business Licenses and Permits

Legal Separation Documents (legal docs that separate you from the business)

These documents form what’s called your CORPORATE VEIL:

Understanding the Corporate Veil: https://quickbooks.intuit.com/r/money/understanding-the-corporate-veil-and-protecting-yourself-from-litigation/

The legal documents are what will protect you and ensure that your LLC will hold up in court. If you ever have a lawsuit that comes about or if you ever get audited you need these documents to prove ownership as well as legal separation.

NECESSARY LEGAL DOCUMENTS:

Complete Bylaws or Operating Agreement

Ownership Certificates

Initial Meeting Minutes and Resolutions

——————————————————————-

Are these really essential at the initial process, because i know definitely i will do this at the later time.

Thanks

Yeah.. they are neccessary. I did it while fixing mine too

I have two questions:

-Does this setup work also if you setup a C-corp instead of an LLC?

-Apparently Stripe now asks for proof that you have a local employee in the US and also a proof of address (like a utility bill for example). Have they not requested this from you?

Thanks

I didn’t get this for mine… prolly they just start asking.

Hi

I have a qustion about final step.

You tald that they required government issued ID. So can i use my driving lisence for that? But i’m from srilanka. Is that ok with account verfication? Or they will reject my ID?

Hope you answer my qustion

Thank you so much for great article.

Yes you can or a passport if you have

You can create multiple stripe account with the same email address

I seriously doubt it

Yes you can

Hi can stripe pay into my local bank account here in Nigeria directly and also can stripe help me open a US bank account

You’ll need to move your stripe funds to Payoneer

Yeah, they did call me. you need to tell them that you’re registering as a non-US citizen and you’re making use of a virtual address.

Hi Olu…. Please clarify, i just got an LLC , i just got a EIN, and now im thinking about getting a virtual address and a phone number from the text app you mentioned before . before i commit to this, i want to please clarify

– i heard that stripe will ask me for physical proof of address how do i go about this

should i email them in advance and be transparent that i have a virtual address, that i am a non US resident… will this transparency harm my application

-should i be transparent about it being a dropshipping business, or might this harm my application as well

anticipating your reply.

Once your LLC is set-up, it comes with a legit address attached to the business, so you don’t have to fake anything.

A very good an updated article, thanks David!

I have a couple of question:

1. Is an accountant needed for this type of business? If yes how can one obtain it?

2. How can one pay the annual business tax (second year and on), is it possible via INC Authority?

3. If your business fails and want to close the business to avoid extra yearly tax charges, how can it be done?

An account will be assigned to you will details to any question you have

Can you please elaborate How to verify Stripe with US phone number, how can i get a US phone number.

Download the textplus app on Google play store, you’ll be given a free US phone No when you create an account.

Hi. Can I shoot you an email?

Sure, you can

Hey David. Thanks a bunch for the info on here. After you set up your Stripe account, how do you now connect it to shopify. I don’t see stripe listed as a Payment gateway provider for US https://www.shopify.com/payment-gateways/united-states. Please clarify. Thanks 🙂

You see the option from your Shopify store

Alright. Cool. Also, with a US based company, can i just use shopify payments directly instead?

David please how do you pay your taxes as a Non US resident/citizen running a US based business?

Hey David,

I was filling the application. But it still asks the last 4 digits of SSN. I tried from the Shopify payment section and from the stripe account. When i applied “0000” at the end of the numbers. Here it says:

“Invalid SSN last 4. “0000” is not permitted”

Help asap! thanks

Thank you so much for sharing this helpful information. I was searching for about two weeks and finally I found something useful. But now I am wondering about taxes. Are you paying taxes with the same rate as us resident?

If you write an article explaining the taxation process as non us resident owner of llc working online, this will help so many people. Thank you again.

Do i have to pay taxes or will i need accountant to file it?

How tax will work in this case

You will when your business start running.

Hi David, Thank you very much for the amazing post. I just want to know if this will work for It Services also ?

Services as how?

Hi! Nice post!! Is working this way nowadays or something has changed? Please tell me before i start the process. Thank you very much for sharing this info!

Yeah… it worked for me when I did it!

Thanks for the enlightenment, i have a Payoneer account which i use to receive payment from amazon can i use it to register my stripe account?

You need an EIN number!

Hello David,

Please I am told that textplus is no longer available in my region. What other options do we have please?

You can also use DingTone.

Hi Great post,

I have all documents and I am running my e-comm business with Shopify using PayPal payment gateway. But the issue is I am planning to take Shopify stripe account but I am a non-US citizen.

I have submitted all documents for getting stripe account, but I got a email requesting they need .

Proof of address Utility bill (e.g. water, electricitfy, gas bill), we won’t accept anything else.

Can you please let me know what is the solution now.

If your LLC is set-up, you can provide them with the requested document

How please? Will Inc Authority provide the utility bill proof of address?

Your passport or ID is all you need

that’s really a very helpful guide thank you, I just have one question you said you called them to send it to you by email who’s the person you called? and can I email them instead?

One of their personnel will be assigned to you and you’ll also be provided with means at which you can reach them. Both phone and email.

Which “Id” am I to upload during stripe verification?

Any valid ID

As a Nigerian is it safe to upload my national ID or international passport ID for stripe verification?

yeah… It doesn’t mean anything

Hello,

This was very helpful, I have a question though. I have my stripe account already under my LLC as a non-resident, but today I received an email stating that I need an SSN to verify my identity, how do I resolve that so my account won’t get closed. I specified that as an owner I’m residing in the US.

Thank you for your help,

If you specify that you’re in the US they’ll ask for your SSN

Hi I’ve completed the whole process but I can’t make the final payment.

It’s telling me the payment is declined by my bank

What should I do

Call their customer care line… they should be able to work

Well done. Very well written and explanation. I am a fellow African from South Africa.

I would like to start a paid newsletter with Revue but they only use Stripe.

My other need is to use them to send money from Airbnb but I can use pioneer. I think.

Have fun.

Thanks, David, this really helps a lot.

I just completed the application at Inc Authority by following the steps you mentioned above.

In my application, I provided the business address in Nevada and state as ‘Kentucky’ (where I want to set up LLC).

Do you think it will create any issues or the business address and the LLC state should be the same?

Thanks,

Hardik

I really doubt if that’s going to be an issue. However, just to be sure, someone should call you from INC, you also tell them if it’s going to be an ISSUE.

Thanks David I have paid for the llc but they request for ssn that I should fill a form and they request for ssn in the form and I call they the customer service told me to write foreign citizen in the ssn space and she also said it going to take 45 days before I get my EIN, I want to ask if it takes this long to get the EIN

Yeah, the EIN around two to three weeks before I saw mine.

Does IncAuthority accept non-us citizens also they will accept my ID if I’m not from US?

Yes they do

can we create stripe account without using VPS or VPN from non supporting countries?

Of course, I don’t use VPN for my account

Please david, is it any type of website that can be used to verify stripe?

Website with less risky business models

Please David, can one use stripe without adding international passport?

You’ll need your personal detail for verification. Any sort of ID